2023 Africa Startup Report

The Year 2023 surely has been interesting, and one that has a lot of memories, and achievements to remember. The data from our Exponential Africa (ExpA) Database, with more investigation and data from outside resources like news articles and websites of African startups, enabled us to compile a well detailed information on the progress made thus far.

With the vision in mind, we have been able to provide early-stage risk financing, project management, financial and strategic guidance, and help for business expansion, including M&A to businesses of all sizes in Africa and Japan, including start-ups, Japanese enterprises, and government agencies. Having touched various sectors of the African industrial landscapes like mobility (SafeBoda), space tech (WarpSpace), asset financing (Asaak), smart logistics (Easy Collect and Drop), agritech (Hello Tractor), biotech (Nawah), healthtech; and keeping a solid relationship with leading partner organizations like Google, Deloitte, Yamada, Uber, Shell, L’Oreal, Zeta, Allianz, etc. as well as angel investors, we have thus made tremendous successes over the entire year.

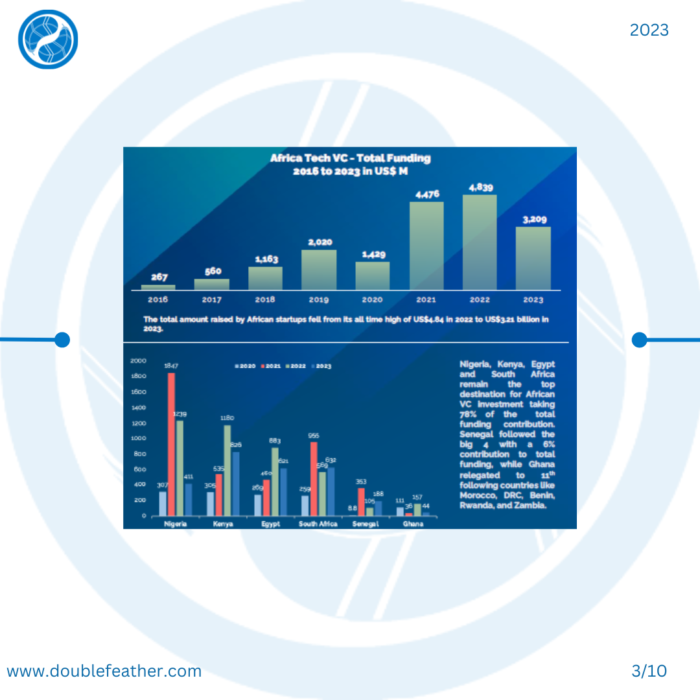

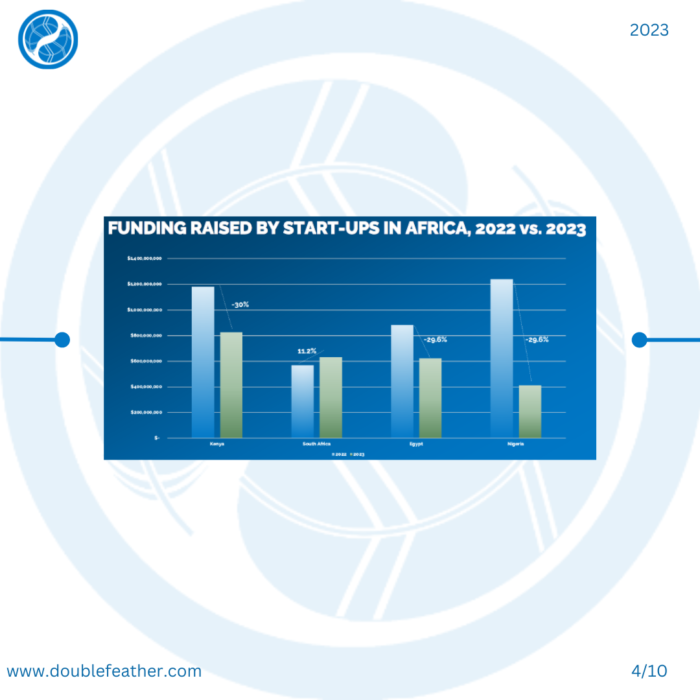

Over the year 2023, a total number of 580 deal rounds were recorded (45% short of 2022), with seed-stage transactions taking a huge chunk of the value (24%). Although other transactions retained their similar trend from 2022 to 2023, debt funding increased by 392% over the one-year difference. This is largely caused by the sharp decline in Venture capital investments worldwide in 2023, down more than 50% from $293 billion in 2022. Also, South Africa recorded the most funded ecosystem within the Continent, amongst the big four – Kenya, South Africa, Egypt, and Nigeria.

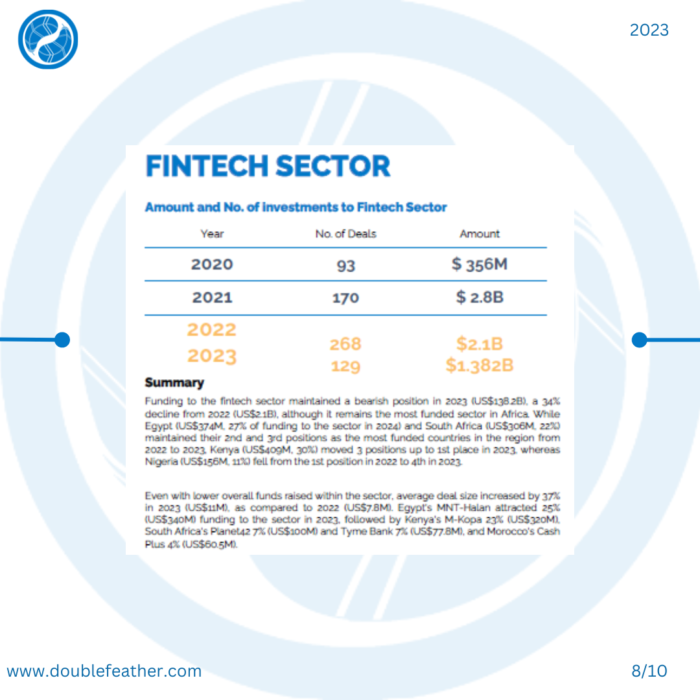

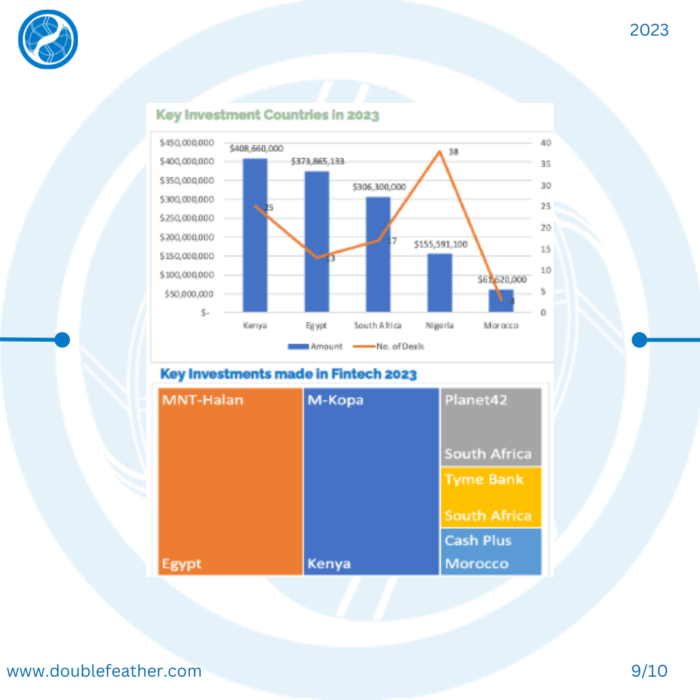

In the same vein, mergers and acquisitions occurred, which provided highlights to the entire investment period. From the 100% acquisition of Qualified to FairMoney’s acquisition of PayForce in a cash and stock deal of about US$15m to US$20m, to mention but a few, the rate of development of these startups are sure signs of collective efforts put together. Similarly, Fintech continued to lead the African tech scene in 2023, accounting for 24% of deals with 113 equity transactions—a 48% decline from the 217 transactions recorded the year before.

Overall, the progress made in the year 2023 is only a stepping stone to the times ahead, and how largely prospective the future looks for all and sundry. Although challenges are bound to be on the way, we will not stop pushing toward the advancement of our vision within the startup ecosystem.

Special appreciation to all who have made this last year a huge success. To our associates, partners, investors, professional firms, government and public agencies, international organizations, and DFIs, we say a big Thank You, as we also look forward to the year ahead.

Preview the report (slideshow):

Please donate a discretionary amount to download this report:

Alternatively, download this report for free: