Electrifying the Future: Sparking Africa’s Electric Transport Revolution.

The electric vehicle (EV) market in Africa, while in its early stages, is gaining momentum with significant government support and incentives. This aligns with the global trend towards environmentally friendly transportation. According to McKinsey & Company’s report, “Why the Automotive Future is Electric,” EVs are expected to make up 80% of all vehicle sales worldwide by 2050. Sub-Saharan Africa is no exception to this growing interest in EVs and the essential charging infrastructure. Multiple charging stations are cropping up across the continent to accommodate the growing demand. Africa is well-positioned for substantial expansion in the electric vehicle (EV) sector, propelled by factors like heightened environmental consciousness, favorable government initiatives, and urbanization. Escalating fuel expenses and petroleum product taxes are encouraging people to transition to electric vehicles.

Several African nations are taking proactive measures to encourage EV adoption through incentives and subsidies:

- Rwanda: The Rwandan government is providing tax incentives, exempting electric cars, spare parts, batteries, and charging station equipment from VAT, import, and excise duties. This move aims to make EVs more affordable and promote their adoption.

- Kenya: The Kenyan government has set a target for 5% of newly registered vehicles to be electric by 2025. They are offering incentives such as zero-rated supplies of electric buses and bicycles, as well as an exemption from excise duty for imported and locally assembled motorcycles.

- Egypt: Egypt has introduced a pioneering financing program for EVs, providing customers with financial support to facilitate access to eco-friendly transportation options.

- Ghana: Ghana is developing a policy framework to promote EVs in public transportation, aligning with its goals of reducing greenhouse gas emissions and lowering transportation costs.

- Tunisia: The Tunisian government has reduced customs duties on EV charging equipment and VAT, aiming to deploy 50,000 electric cars by 2025.

- South Africa: The South African government is exploring tax incentives and investing in green energy and e-mobility to boost its auto exports.

African nations are also committing significant investments to establish EV manufacturing facilities. South Africa and Morocco are even considering the construction of mega and giga factories to meet the global demand for EVs. Furthermore, ride-hailing service providers are playing a pivotal role in driving EV adoption by integrating them into their fleets. For instance, Uber has introduced its Electric Boda service in Kenya, with plans to deploy 3,000 electric bikes within six months. This not only reduces operational expenses but also offers users cost savings, further accelerating the adoption of electric transportation in Africa. Collectively, these initiatives underscore the increasing momentum and dedication across Africa to transition towards cleaner and more sustainable transportation options. This transition contributes to a greener and more eco-friendly future for the continent. Additionally, Bolt is planning to invest a minimum of Ksh100 million ($684,931) in the Kenyan market to incorporate electric mobility (e-mobility) solutions into its offerings. Presently, the company operates 40 electricity-powered bicycles (e-bikes) for deliveries in Nairobi.

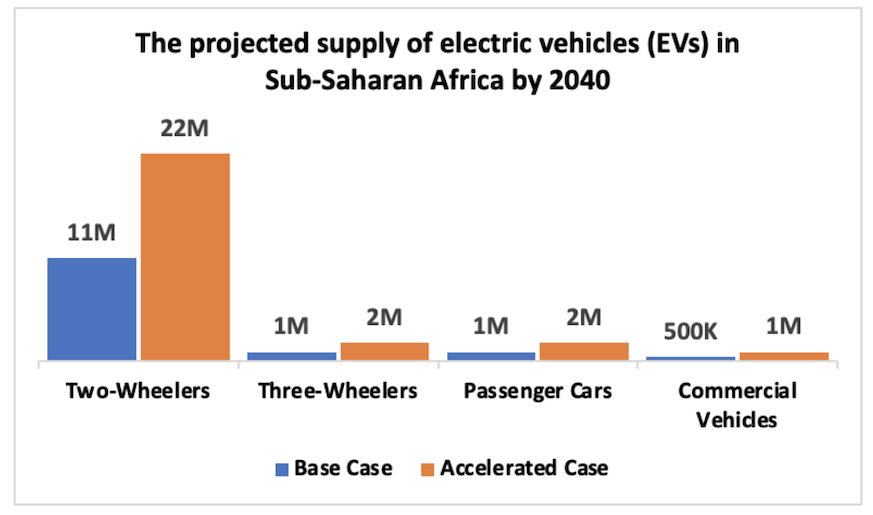

Source: (UNEP, 2023)

Projections for the stock of electric vehicles (EVs) in sub-Saharan Africa by 2040 vary, with estimates of 13.5 million in the base case and 25 million in the accelerated case. The base case assumes that current trends continue, while the accelerated case envisions significant policy interventions expediting the transition to EVs. Notably, electric motorcycles are expected to play a pivotal role in sub-Saharan Africa’s EV landscape, as the majority of EVs in the region will likely be two-wheelers. This is due to the affordability, durability, and maneuverability of two-wheeled vehicles, making them an appealing choice for African riders who rely heavily on such transportation. According to UNEP (United Nations Environment Programme), the two- and three-wheeler markets, as well as e-buses, hold the most promise for e-mobility in the region. In West and East Africa, the importation of two- and three-wheelers exceeds that of cars, underscoring the sector’s significance.

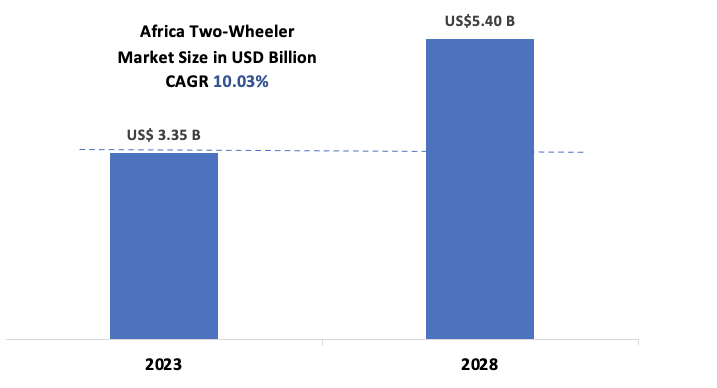

The projected value of the African market for two-wheelers is approximately $3.35 billion in 2023, with a forecasted increase to approximately $5.40 billion by 2028. This growth is anticipated to occur at a compound annual growth rate (CAGR) of around 10.03% over the period from 2023 to 2028.

Market Size of African Two-Wheeler Industry

Source: (UNEP, 2023)

The growth of e-mobility in Africa faces several common challenges, including low demand for electric vehicles, inadequate regulatory frameworks, high power costs, limited technical expertise, insufficient financing, and unreliable energy and charging infrastructure. Despite these hurdles, Africa possesses abundant mineral resources like lithium, copper, and cobalt, positioning it to manufacture EVs and emerge as a significant industry player. To attract investments from global original equipment manufacturers (OEMs) with extensive supply chains, African nations need to position themselves as a unified regional market. This approach can pave the way for substantial progress in the e-mobility sector across the continent.

Opportunities and challenges to EV in Africa can be divided into four regions.

McKinsey’s projections indicate that by 2040, 90% of all two-wheelers and 70% of car sales are expected to be electric, with India, China, and Southeast Asia driving the demand. While Sub-Saharan Africa is anticipated to have lower figures, there is still significant potential for growth. Accelerated adoption rates suggest that the number of EVs on the road will double by 2023 and increase by 30% by 2024, despite shared challenges. In West Africa, the Economic Community of West African States (ECOWAS) has adopted vehicle emissions regulations, including an age limit for used vehicles, which is a positive step toward increasing EV adoption in the region. East Africa has been a focal point for Africa’s transition to electric transportation, with countries like Rwanda offering tax exemptions, lower power rates, zero taxes on EV consumables, and rent-free property for charging stations. Kenya aims to have 5% of all newly registered vehicles electric by 2025. North Africa, including Egypt, Tunisia, and Algeria, is focusing on local manufacturing and incentives for EVs. Algeria plans to transition from hydrocarbons to renewable energy by converting ICE vehicles to LPG and CNG vehicles. South Africa is the most developed market in the Southern African region, with initiatives to support charging infrastructure and incentives for EV adoption. Other countries like Namibia and Zimbabwe are also incentivizing EV adoption.

However, common challenges affect most African countries, such as the dominance of the used vehicle market, affordability concerns, electricity reliability issues, and inadequate charging infrastructure. Despite these challenges, there are opportunities for a well-functioning ecosystem, including investments in scaling electricity and charging infrastructure, promotional incentives for players in the EV supply chain, and the significant growth potential of the African market, with the population expected to double by 2050. This growth will require extensive infrastructure support within the EV sector, making first movers well-positioned to benefit from market control and patronage within the emerging ecosystem. Adopting EVs has become pivotal to global environmental sustainability and climate change. However, Africa’s EV market share is less than 1%, lagging behind other regions. Building an enabling ecosystem that addresses unique challenges and opportunities across the continent is crucial for electric vehicles to thrive in Africa, which has fast-growing urbanization.

Below are five (5) suggestions that can facilitate EV transition in Africa.

- Infrastructure Development: Establishing efficient power generation and distribution is critical for building a charging infrastructure for EVs. While South Africa and Morocco have more advanced auto markets, other African nations, such as Nigeria, face challenges due to unreliable power supply. Addressing this issue requires investments in efficient power generation and distribution, including renewable energy sources, to support EV growth.

- Policy Incentives: Governments and regulatory bodies play a vital role in creating the right policy environment for driving EV adoption and addressing climate change. Some countries, like Rwanda, Kenya, the Seychelles, Zambia, and Mauritius, have waived or reduced taxes and duties for EVs. Other potential policies include enforcing stricter emissions standards and offering incentives for local manufacturing of EVs and components.

- Capitalizing on Local Resources: Africa boasts approximately 65% of the world’s cobalt reserves, a crucial mineral for battery production. Promoting local extraction and processing, especially in countries like DR Congo, can reduce battery costs, making EVs more affordable. Additionally, local manufacturing can create jobs and reduce vehicle import costs.

- Collaborative Initiatives: Public-private partnerships have the potential to accelerate the EV revolution in Africa. For example, Untapped Global (Kenya) has initiated a $20 million Climate Action Initiative to promote EV use across the continent. Increased collaboration among governments, vehicle manufacturers, tech companies, and energy providers can expedite the development and deployment of EVs and required infrastructure.

- Financing Solutions: High upfront costs pose a significant barrier to EV adoption in Africa. Governments can collaborate with financial institutions to offer tailored financing solutions, making EVs more accessible to a broader segment of the population.

Market Dynamics for EV in Africa

The traditional dominance of automotive manufacturers (OEMs) in the industry is driven by cost-effectiveness, robust supply chains, and strong brand recognition. In contrast, Electric Vehicles (EVs) currently come with high initial prices, limiting accessibility for middle-class consumers in Africa. Some OEMs, like Renault with its Dacia model, have succeeded in offering competitive pricing by simplifying features, catering to the affordability of African customers. The key factors influencing EV adoption are availability and affordability. A significant shift in vehicle segments dominated by used vehicles is unlikely until after 2035 when an adequate supply of used EVs becomes available, particularly compared to used Internal Combustion Engine (ICE) vehicles. Sub-Saharan Africa sees about 80% of four-wheeler sales as used vehicles, driven by affordability and lenient regulations allowing the import of older vehicles with relatively low emissions standards.

The most compelling business case for electrification is in public transportation, particularly the bus industry, which primarily serves domestic markets. Furthermore, the electric two-wheeler market is poised for substantial growth, driven by factors such as Total Cost of Ownership (TCO) benefits and high fleet turnover, following trends seen in Asia. However, challenges like electrical reliability, especially in countries like Nigeria, may hinder adoption rates unless infrastructure investments improve. Local players have a unique opportunity to dominate the African EV market, as international OEMs are unlikely to heavily invest in Africa-specific EV models. Standard European and US models often do not align with African conditions, including harsh environments and poor road quality. Although some startups, such as Ampersand in Rwanda and Roam (Obipus) in Kenya, focus on specific niches like bus conversions and motorcycles, a major African EV manufacturer has yet to emerge.

Conclusion

In summary, the electric mobility (E-mobility) sector in Africa is evolving with considerable growth potential and sustainability. Challenges such as high initial costs, infrastructure limitations, and a market dominated by used vehicles persist. Nevertheless, some African countries, like Rwanda and Kenya, are actively promoting electric transportation through incentives and targets. Local startups, particularly in the electric two-wheeler segment, are emerging, signifying the beginnings of a promising ecosystem.

However, there is a pressing need for sustained investments in infrastructure development, awareness campaigns, and policy incentives to make electric vehicles more accessible and affordable for a broader African population. As technology advances and more nations embrace sustainable transportation practices, the E-mobility sector in Africa is poised for significant expansion. This growth will lead to reduced carbon emissions and contribute to a more environmentally friendly and economically sustainable transportation landscape across the continent.