DFP Africa Startup Brief (September 2025)

Africa’s startup ecosystem often remains opaque to outside observers. The DFP Africa Startup Brief delivers curated updates on their fundraising, M&A activity, and other key developments—based on firsthand information gathered on the ground by DFP staff based in Africa—accompanied by expert commentary and analysis.

1. African Startup Fundraising Trends (Based on Disclosed Transactions)

(1)September, 2025

[Overview]

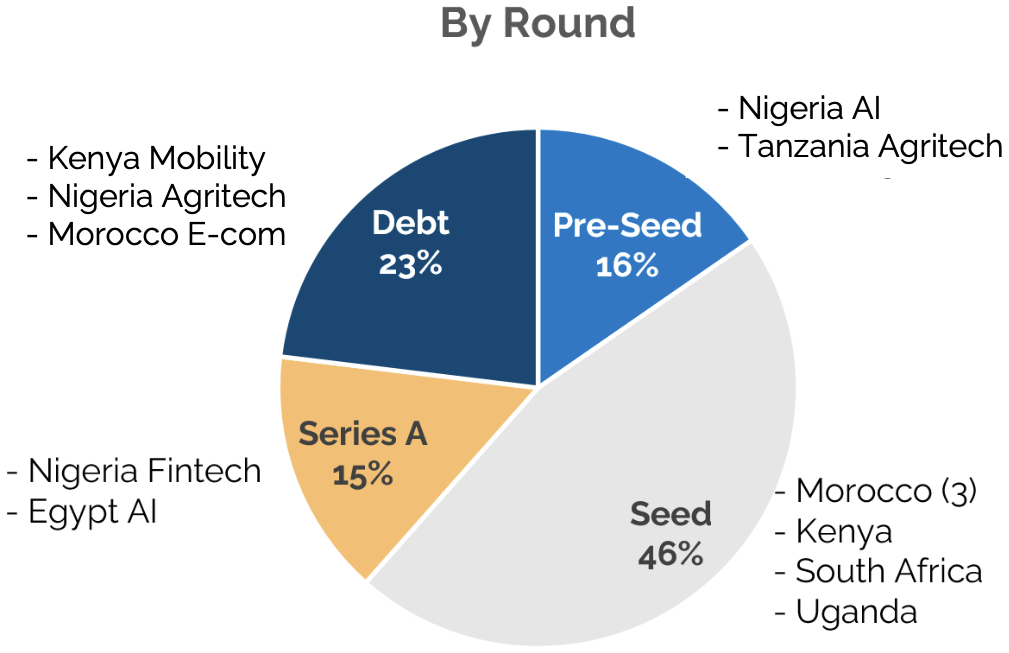

In September, 20 startups across 9 countries raised funds, showing activity across diverse sectors including fintech and agritech. Notably, two companies in Nigeria and Egypt successfully closed large Series A rounds exceeding USD 10 million each, while early-stage funding (Pre-Seed and Seed) also remained active, with 8 companies from 6 countries securing investments.

[Facts]

Total funding:

USD 117 million

20 startups across 9 countries

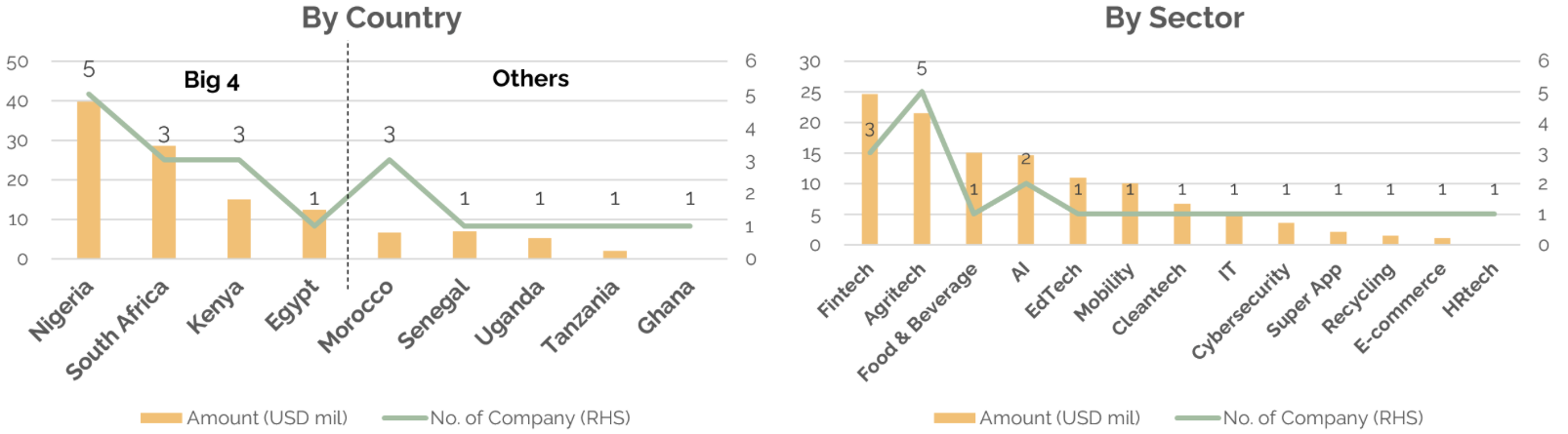

By country (see chart below):

Big 4 (12 startups, USD 96 million)

Others (5 countries, 8 startups, USD 21 million)

Major fundraising:

・Kredete (Nigeria, Fintech): Series A, USD 22 million

・Pura Beverage (South Africa, Food & Beverage): Undisclosed, USD 15 million

・Intella (Egypt, AI): Series A, USD 12.5 million

Investments by Japanese investors:

n.a.

(2)Cumulative Figures for 2025 (January–September)

Key Trends in African Startup Funding (January–September 2025)

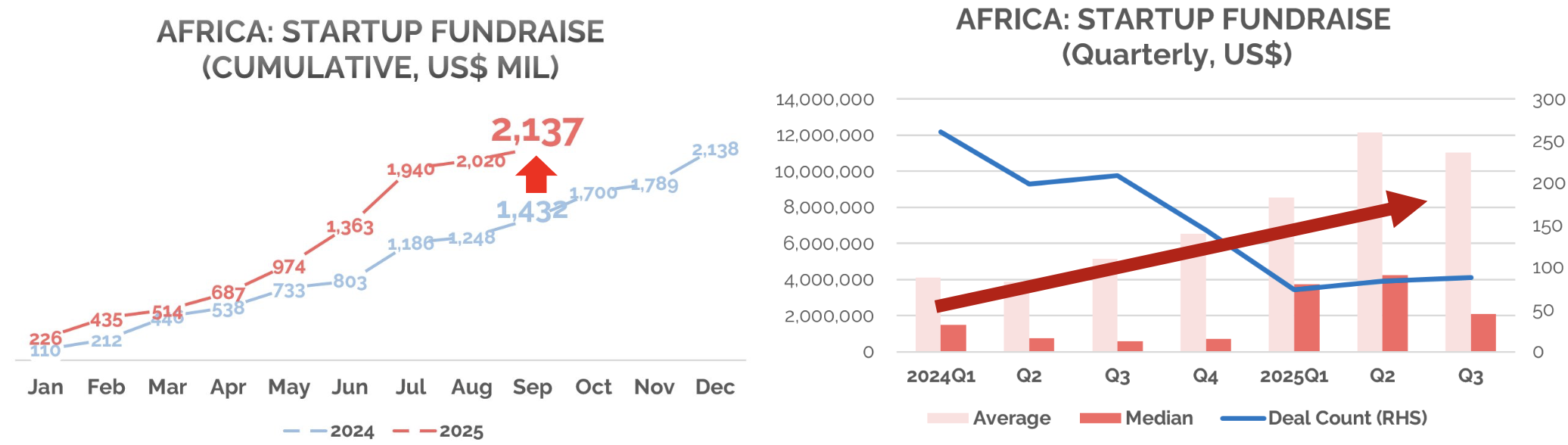

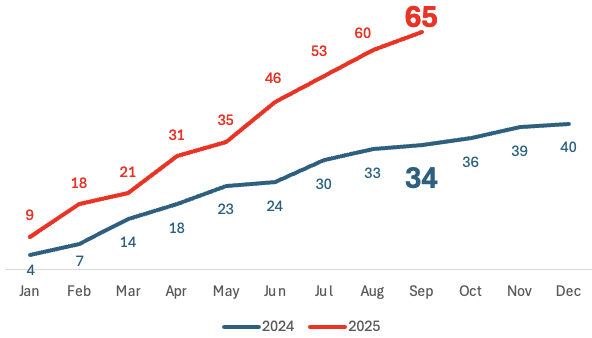

- African startups have continued to attract strong funding momentum in 2025 (see chart at lower left). During January–September 2025, total funding increased by 49% year-on-year, marking a significant rise compared to the same period last year.

- A notable trend is the increasing selectivity and concentration of investments. While total investment amounts have grown, the number of deals has declined, leading to a sharp rise in both average and median deal sizes (see chart at lower right). This indicates a shift toward quality-focused investment behavior.

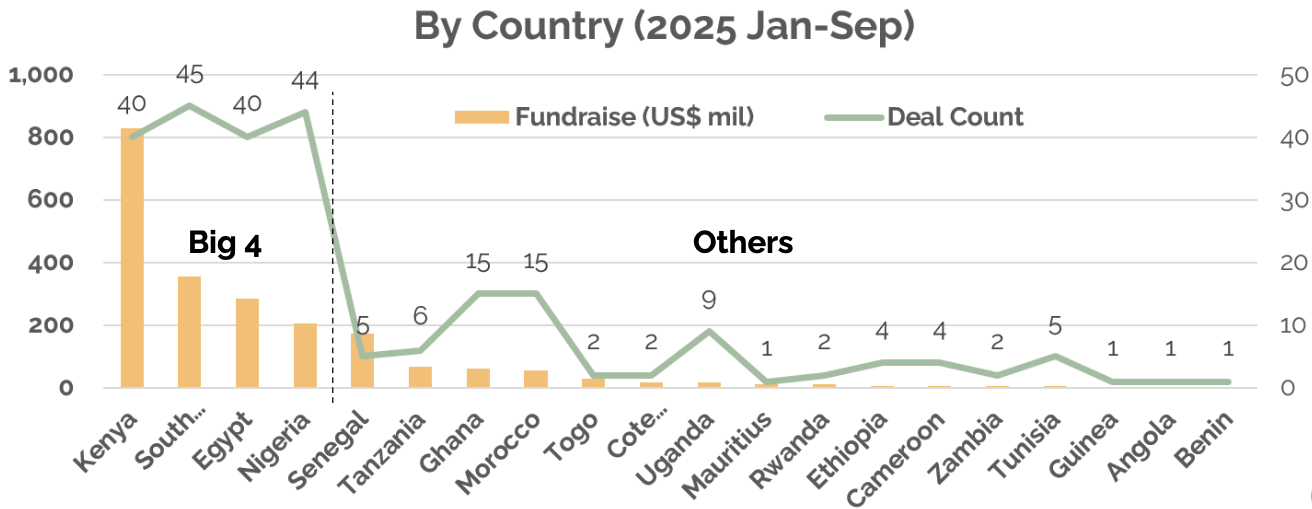

Country Breakdown (January–September 2025)

- Big 4 (Nigeria, Kenya, Egypt, South Africa) accounted for 69% of deal volume and 78% of total funding. Meanwhile, countries such as Senegal, Tanzania, Ghana, and Morocco also saw notable funding activity.

Top 3 Deals (January–September 2025)

- d.light (Kenya, Renewable Energy, Debt): USD 300 million

- Sun King (Kenya, Renewable Energy, Debt): USD 156 million

- Wave (Senegal, Fintech, Debt): USD 137 million

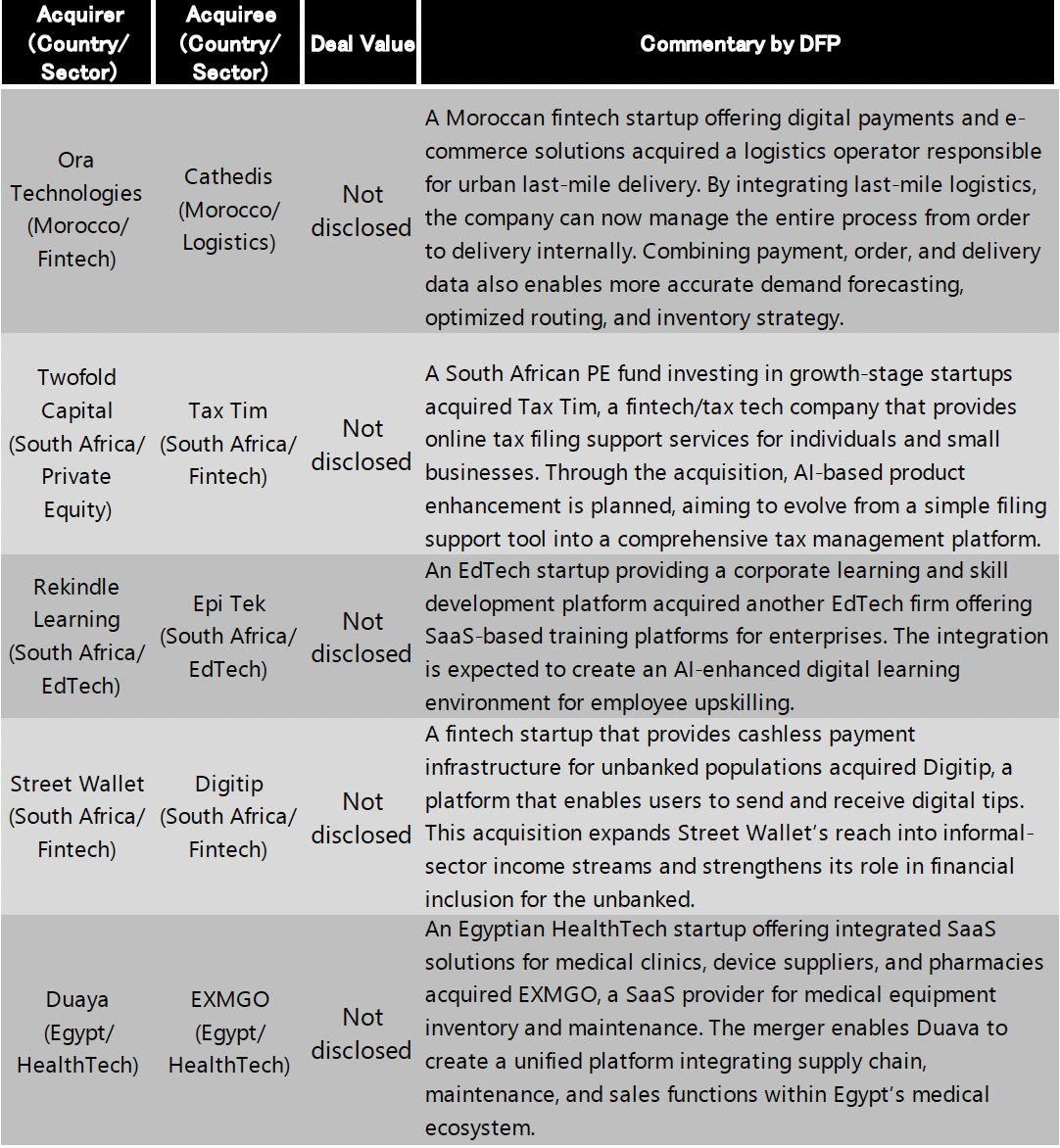

2. African Startup M&A Activity (Based on Disclosed Transactions)

Steady Progress in Locally-Led Vertical Integration Deals

In September 2025, five deals were reported.

As a result, the cumulative total from January to September 2025 reached 65 deals, marking a 91% increase compared to the same period last year (see chart below).

Contact

Double Feather Partners Inc.

Insights & Strategic Planning Department –

Satoshi Nakagawa, Albert Mbithi, Emma Kiserema <insight@doublefeather.com>

Disclaimer

This document has been prepared by Double Feather Partners Inc. solely for informational purposes and does not constitute an offer, solicitation, or recommendation to purchase, sell, or hold any specific securities, financial products, or investment strategies. The opinions, forecasts, and views expressed herein reflect the judgment of the author(s) at the time of publication and are subject to change without notice. While efforts have been made to ensure the accuracy and completeness of the information contained in this report, no guarantee is provided. Readers are advised to make investment decisions at their own discretion and responsibility.